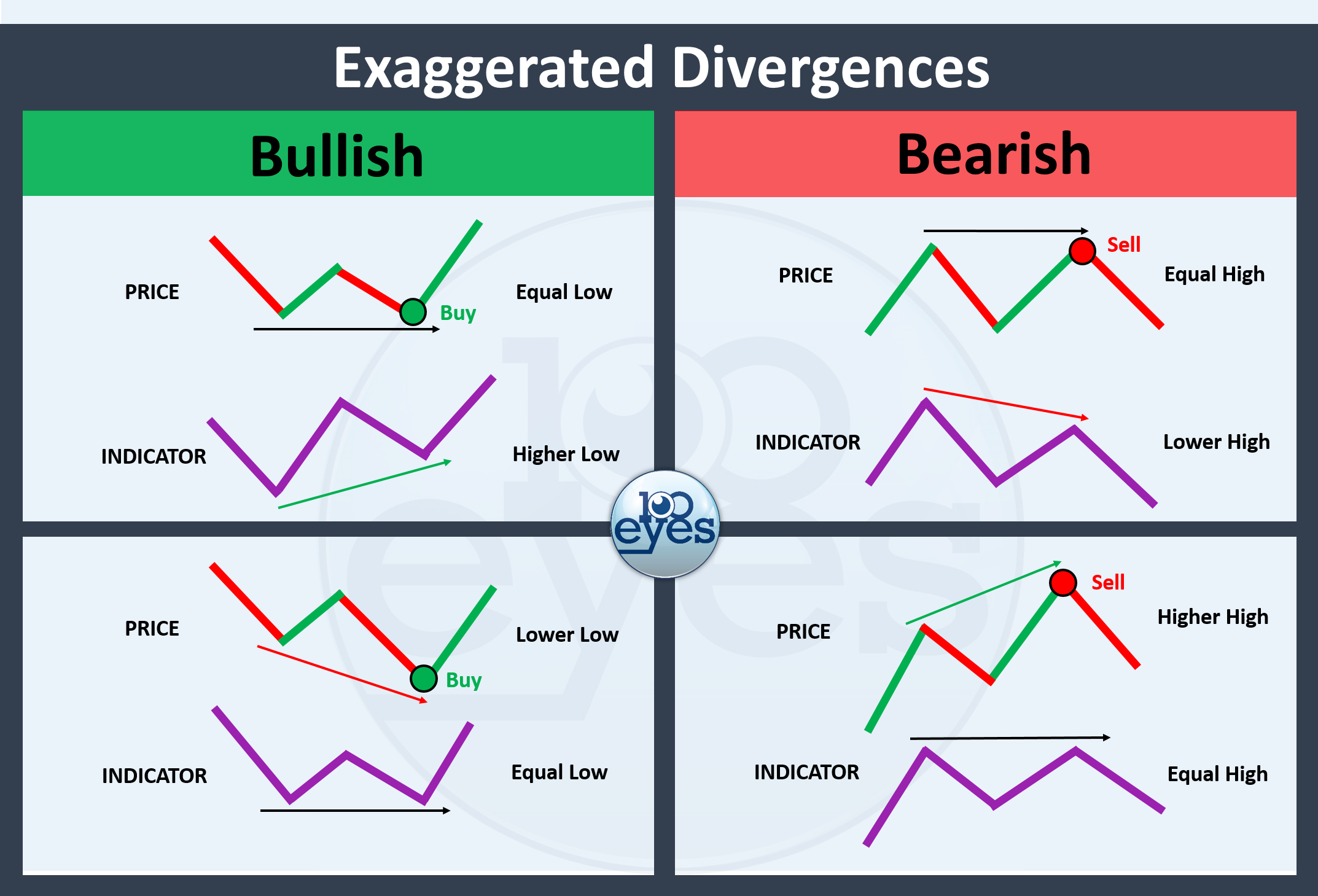

Exaggerated divergences

Exaggerated divergences are similar to regular divergences, but are considered weaker and less predictive variations. The term exaggerated refers to a circumstance where either the oscillator or price makes an equal high or low. Regular bullish divergences and regular bearish divergences both have two exaggerated variations, so there are four exaggerated variations in total. The cheat sheet below shows all four exaggerated variations of divergences.

About 100eyes

Stop spending hours of your time searching for good entries. Make your crypto or forex trading easier by using the 100eyes scanner.