Risk Reward Ratio (RRR)

Risk Reward Ratio is a very important concept in trading, whether you are trading crypto, forex, or any other market. It compares the potential Risk (R) of a trade to the potential profit. For example, a RRR of 1:3 (or just “3”) means the potential profit is three times higher than the potential loss. In case of a favorable outcome, the profit of a trade can be defined as 3R, which means three times the original risk. There is no complicated formula.

In trading, long term profitability will be determined by the balance between average RRR and win rate (also known as Win/Loss) over a large amount of trades. Generally when a strategy involves a high RRR, the win rate will be low. When RRR is low, the win rate is usually high.

Traders often have conflicting opinions regarding this balance between RRR and win rate, since there is no holy grail in terms of profitability. However – while acknowledging exceptions – we argue that strategies involving a RRR higher than 2 are more likely to be profitable in the long run.

Before(!) entering a trade, it is wise to calculate the Risk Reward Ratio. The chart below shows an entry level (at the green “buy” sign), a stop loss level and a take profit level. Although the outcome is unknown at this point, we can see that the Risk Reward Ratio is 2.6, which means the potential reward is 2.6 times higher than the risk. In Tradingview, the tool displayed in the chart below is called “long position tool”.

About 100eyes

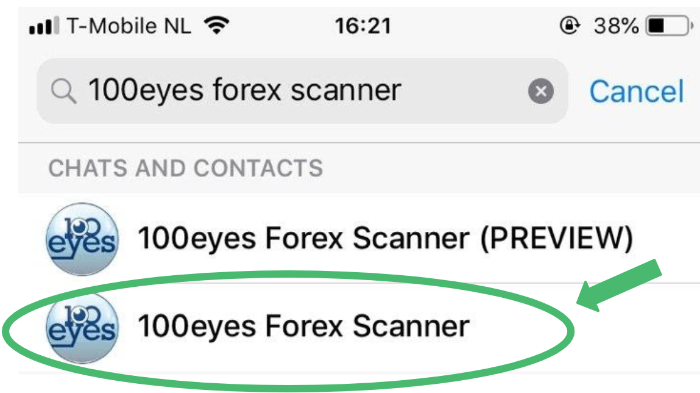

Stop spending hours of your time searching for good entries. Make your crypto or forex trading easier by using the 100eyes scanner.