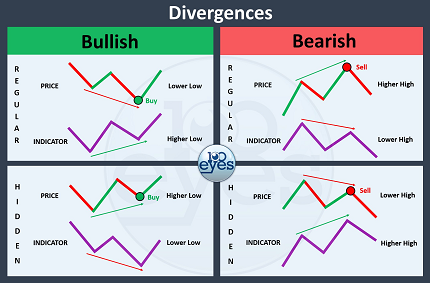

Hidden Bullish Divergence

A Hidden Bullish Divergence is considered a continuation signal in an uptrend. It refers to a circumstance where an oscillator reading falls down below its previous low, while price is still higher than its previous low.

Hidden bullish divergences are most likely to occur in the middle of an uptrend – often after a healthy pull back – and indicate that the uptrend will most likely continue.

The starting point of a hidden bullish divergence should be a clear swing, not just a red candlestick.

Hidden Bearish Divergence

A Hidden Bearish Divergence is considered a continuation signal in a downtrend. It refers to a circumstance where an oscillator reading rises and breaks out above its previous high, while price is still lower than its previous high.

Hidden bearish divergences are most likely to occur in the middle of a downtrend – often after a healthy pull back – and indicate that the downtrend will most likely continue.

The starting point of a hidden bearish divergence should be a clear swing, not just a green candlestick.

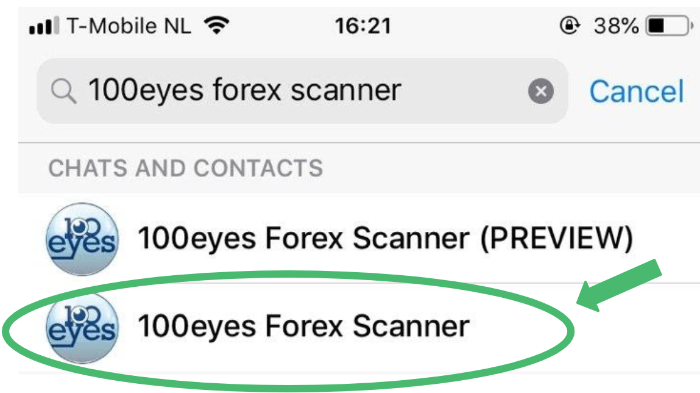

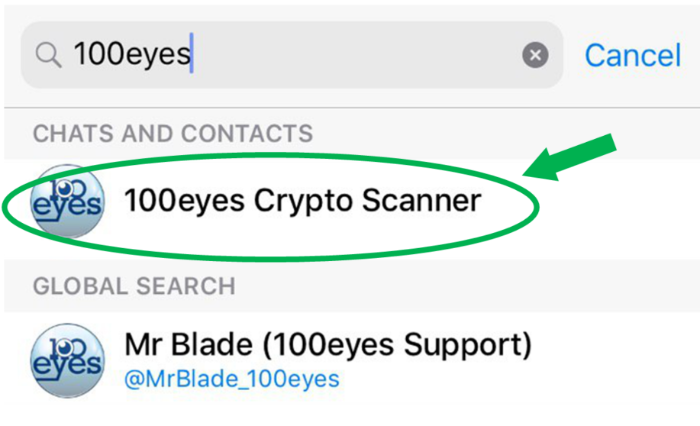

About 100eyes

Stop spending hours of your time searching for good entries. Make your crypto or forex trading easier by using the 100eyes scanner.