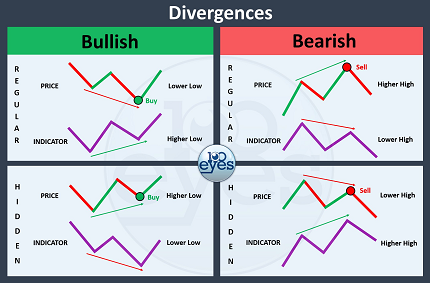

Regular Bullish Divergence

A Regular Bullish Divergence is considered a strong reversal signal in a downtrend. It refers to a circumstance where price falls and makes a lower low, while the corresponding oscillator reading is still higher than its previous low.

Bullish divergences are most likely to occur in strong downtrends and signify that downward momentum is weakening. A reversal – or at least a pull back – is then expected to follow. Regular bullish divergences also appear in exaggerated form.

Regular Bearish Divergence

A Regular Bearish Divergence is considered a strong reversal signal in an uptrend. It refers to a circumstance where price rises and makes a higher high, while the corresponding oscillator reading is still lower than its previous high.

Bearish divergences are most likely to occur in strong uptrends and signify that upward momentum is weakening. A reversal – or at least a pull back – is then expected to follow. Regular bearish divergences also appear in exaggerated form.

About 100eyes

Stop spending hours of your time searching for good entries. Make your crypto or forex trading easier by using the 100eyes scanner.